Atlanta Car Accident Lawyer

- $1,700,000

-

Car accident

settlement

- $1,093,000

-

Car accident

settlement

- $1,150,000

-

Car accident

settlement

Car accidents can change your life and your loved ones’ lives forever. The physical injuries, emotional trauma, and financial hardships caused by an accident can be challenging to deal with, and many people and their families suffer significantly as a result.

You didn’t wake up expecting your life to change, but this happens all the time in the busy city of Atlanta. Car accidents happen all the time within the Perimeter. And the especially serious accidents also end up being the most expensive. It would help if you didn’t have to pay for the negligence of another driver, and Atlanta car accident lawyer Mike Rafi knows how to make sure those who hurt you are held accountable.

If you or a family member have been seriously injured in a car accident and need compensation to cover your injuries and life changes, contact an experienced Atlanta car accident lawyer at the Rafi Law Firm to represent you. We will make sure all damages are taken into account, not just the ones with a dollar amount. Serious injuries can cause significant changes, and the personal injury attorneys at Rafi Law Firm are here to help you ease through those transitions while holding those who are responsible for your injuries accountable for their actions.

How We Can Help You With Your Car Accident Case

At Rafi Law Firm, we are committed to representing those who have suffered from personal injuries due to the negligence or recklessness of another person or entity. We win the cases that others can’t win because we are willing to spend the time, energy, and effort to push every case through the lawsuit process. Mike Rafi prepares every case for trial because he knows that insurance companies will try to keep their money in their pockets.

We Will Protect Your Rights

While insurance companies may try to trick you into giving a statement that can be twisted, Mike Rafi knows better. Most communication will be handled through your lawyer so that you won’t be bothered by calls every other hour, and Mike will give you updates on your case routinely.

Don’t Pay Unless We Win Your Case

With absolutely no risk to you, Mike will put up all court costs and fees for your lawsuit. Mike does this because he only takes cases he believes he can win, so if he does lose, you pay nothing, and his firm absorbs the cost of the lawsuit.

We Always Pursue Maximum Compensation

Mike Rafi knows that insurance companies will try to deny and diminish your claims for personal injury in any way possible so they don’t have to pay much out of their own pockets. No matter what they try, our lawyers will pursue maximum compensation for your pain and suffering, including economic, non-economic, and possibly even punitive damages.

Related: What Does a Car Accident Lawyer Do?

Contact an Atlanta Car Accident Lawyer Today

If you’ve been injured and need representation, contact us for a free, no-obligation consultation about your case.

We treat every client with honesty from the beginning. Because we work on a contingency fee structure, you don’t pay anything unless we win your case. We pay all of the filing fees and litigation costs upfront so that you can focus on healing during this process. If we take on your case, you can rest assured that we believe we can win from the beginning, and there is never any risk to you.

You will be a priority and will be treated with compassion at our law firm. Mike Rafi is here to help all of those who the recklessness of others has hurt.

What Should You Do After a Car Accident in Atlanta?

In the event of a car accident, you want to call the police to expedite any emergency services that may be needed on the scene and to make sure the car crash is as accurately recorded as possible. If your case goes to court, the police record of your car accident will be pivotable in proving negligence.

This means take pictures of your injuries and the injuries of anyone in your party. Take pictures of the damage done to your car and the other car as well as any road conditions that would be useful to know, like a stop sign being blocked by a hanging tree. These pictures will come in handy when preparing your case.

Many times, people don’t realize that they are injured until well after a car accident. It is important to get tests on anything that hurts in case your adrenaline is covering up potential lingering issues and tell your doctor everything.

Do what your doctor says. Follow your doctor’s instructions, including getting necessary tests, completing treatment, and seeing specialists. If you are not feeling better, go back to your doctor and explain how you feel.

You will want to order the copy of the police report as soon as you can. The police report is from a third party who was on the scene to assess fault in your car accident. It also records time, date, street conditions, and information on the other driver as well. Keep a copy for your records.

You should call a car accident attorney in Atlanta at 404-948-3311 before you speak to any insurance companies, give any statements, or go to traffic court. Insurance adjusters may seem like nice people, but their only concern is to keep money in their own pockets. Protect your rights by getting experienced legal representation.

You are responsible for reporting an accident to your insurance company. Importantly, all you must do is report the accident and provide the basic details—where the accident occurred and who was involved. You should not and do not need to provide your insurance company a statement or detailed account of the accident or your injuries right after the wreck.

Do not write on social media about the collision, the other driver, your injuries, your doctors, or anything else that could be used against you.The insurance adjusters are waiting for you to say anything on a public form to be used against you. Don’t give them anything to go off of.

When Should You Talk with a Car Accident Lawyer in Atlanta?

If you have been injured in a car accident in Atlanta, you will likely receive a settlement offer by the insurance company — especially if the accident was the other driver’s fault.

Chances are, however, the offer you are sent will be much lower than what you deserve. Insurance companies are in the business of making a profit, after all, and want to give out as little money as possible.

Once you accept that offer, you forfeit your right to seek greater compensation for your injuries. Because of this, it’s vital to consult an Atlanta car accident lawyer as soon as possible. Unlike the insurance company, your lawyer will act in your best interest by carefully evaluating your case and helping you decide the best path forward in the legal process.

Though you may not need an Atlanta car accident lawyer for a little fender bender in which there were no injuries, you will definitely need an attorney if:

- There were serious injuries and/or property damage

- The accident resulted in a death

- It is unclear who was at fault

- The settlement offer doesn’t cover your expenses

- You’re unsure what your legal options are

Finding the Right Atlanta Car Accident Attorney for Your Case

Mike Rafi, a dedicated car accident attorney in Atlanta, has seen first-hand how car accidents can affect people’s lives. Mike will help his clients seek the compensation they deserve. Mike Rafi and his team of experienced car accident attorneys believe in maximizing the value of every case they work on to help alleviate their clients’ financial and emotional burden.

Since 2016, Mike Rafi has won over $31 million on behalf of his clients. Rafi Law Firm is known as a boutique law firm, meaning we only take on a few cases at a time. Because of this, Mike and our other Atlanta car accident lawyers are able to fully focus on your case and how we approach it . Lawyers at other firms may be handling 10 to 20 cases at a time, if not more.

Of course, every case is unique. We cannot guarantee you will receive the full amount in your claim. In fact, no attorney can–if a car accident lawyer tells you they can obtain a specific settlement amount for your case, run or better yet, drive safely way.

The settlement or verdict we seek on your behalf will be based on the circumstances of your accident, the injuries you sustained, the parties involved in the wreck and other factors. We will always be transparent with you about the outlook for your case and will work with you to obtain the compensation you need and deserve.

What Your Car Accident Lawyer Will Help You Prove

When your Atlanta car accident lawyer takes on your case, one of the most important elements of personal injury law they will consider is negligence. In legal terms, a person acts negligently when they act in a way that a reasonable person wouldn’t and cause harm.

In order to prove negligence, your attorney will consider four general factors:

Broadly speaking, every person has a duty of care to avoid harming another person. This duty looks different in specific situations. For instance, doctors have a duty to care to treat their patients to the best of their ability. Drivers have a duty not to cause harm to others on the road. They must follow all traffic laws and drive defensively.

When a driver doesn’t act in a “reasonably prudent” way, and they cause injury, they are said to have breached their duty of care. However, not every accident is caused by a breach of duty of care. For instance, if a large branch falls in the road and a driver has to swerve to avoid it, causing an accident, that driver may not have breached their duty of care. After all, another reasonably prudent person likely would have reacted in the same way.

Third, your car accident attorney in Atlanta will evaluate whether your injuries were caused by the accident itself, and not some other factor. Insurance companies will look for ways to blame your injuries on other things and not the crash. For example, insurance companies will look back into your medical history to find some other prior event that they can blame for your injuries, like a prior car crash, workplace accident, or sports injury. It is important to have a lawyer who understands the medicine and science about your injury and can successfully show that the car crash is the reason you are hurt.

Finally, your Atlanta personal injury lawyer must prove that you suffered real, monetary damages because of the accident. This is generally the easiest element to prove. Medical bills, pain and suffering, lost wages, and other expenses are perfect evidence that you suffered real damages.

Car Accident Insurance & Investigations

Both the other driver’s insurance company and your insurance company will immediately launch an investigation. Insurance companies make money by paying less on auto accident claims, so their goal is to pay you as little as possible.

The insurance companies will ask you to provide a written or recorded statement explaining how the accident occurred, who was at fault, and how you were injured—do not do it! The insurance companies will twist your words and take parts of your statement out of context, and they will not give you enough time to assess your injuries and receive treatment properly. They may also make low-ball offers and try to rush you into accepting, which will not be in your best interest. Learn about common myths about car accidents insurance companies tell people on our blog.

How Does Georgia Calculate Fault in Auto Accidents?

Comparative fault is the process used to determine who is more responsible for an auto accident. Georgia’s comparative fault laws allow for some debate. Insurance companies will often attempt to insist that the other driver was mostly at fault, as this reduces the amount of damages they’re liable for.

If someone smashes into your perfectly parked car, that individual’s insurance company will have a difficult time arguing that you are at fault. If you were going five miles over the speed limit when the accident occurred, the opposing party’s insurance company is likely to attempt to assign a percentage of the fault to you.

An experienced Atlanta car accident lawyer will be able to help you argue your case. By minimizing your fault percentage, you’ll be entitled to more compensation for your accident. If a compelling case shows that 80% of the fault can be placed on the other driver, you’re entitled to 80% of the damages you requested. The other 20% will be subtracted from the total damages. Anyone found to be 50% or more at fault will not be able to obtain compensation.

Getting Compensation for Your Car Accident Injuries

Under Georgia’s comparative negligence statute, you can receive compensation for your injuries if you are less than 50 percent at fault for the accident. However, the amount of compensation you receive will be lessened by the amount you are at fault.

As an example, let’s say you are rear-ended at night while you’re waiting at a stoplight. You suffer broken ribs and a traumatic brain injury. However, one of your tail lights wasn’t operating correctly. The court finds that you are 20 percent at fault for the wreck because of your tail light, and they award you $100,000 in compensation. Because you are 20 percent at fault, you would only receive $80,000.

What Damages Are Available for Car Accidents in Georgia?

Determining the amount of damages you have suffered is as important as analyzing the circumstances leading to the crash. Car crashes send more than 3 million people to the emergency room each year in the U.S., with injuries including back and neck injuries, brain injuries, and spinal cord injuries. Damages, or compensation that you may be able to recover after a car accident, include economic and non-economic damages.

Economic damages

Economic damages are intended to compensate you for the actual monetary losses you suffered. They are generally easy to prove since you will be able to provide documents and other evidence showing your losses. These include:

- Past and future medical expenses

- Lost wages and future wages

- Property damage

- Speaking to police and first responders

- Out-of-pocket expenses

Non-economic damages

Non-economic damages are a bit more ambiguous. These damages are intended to compensate you for the non-monetary losses you’ve suffered. Your car accident attorney in Atlanta will consult with experts to help figure out how much you’re owed for these losses, including:

Pain and suffering

Loss of enjoyment of life

Mental anguish

Physical disfigurement or impairment

Related: How Much is the Average Settlement for a Car Accident in Atlanta?

Types of Car Accident Cases Rafi Law Firm Handles

At Rafi Law Firm, we handle nearly every type of Atlanta car accident. While this list isn’t exhaustive, some of the most common car accidents we handle include:

Drivers who operate motor vehicles under the influence of alcohol, illegal drugs, and medication pose a danger to the safety of others on the road. Georgia law provides for criminal penalties for drivers who drive while impaired, but those penalties do nothing to directly help the person injured by the impaired drivers. Under Georgia civil law, juries may be told about any and all times when an impaired driver drove while impaired. Further, impaired drivers make a conscious decision to drive even though impaired, and accordingly, punitive damages should be levied against impaired drivers.

Punitive damages are a sum of money that is required to pay in order to punish and deter the driver and deter the community as a whole from driving while impaired. A jury will decide how much money is appropriate.

If you’ve been involved in an accident involving an impaired driver, contact an Atlanta drunk driving accident lawyer today at 404-948-3311.

When operating a motor vehicle, a driver’s primary job is to drive safely and pay attention to the road. Georgia’s distracted driving law is very broad, and states in part that “a driver… shall not engage in any actions which shall distract such driver from the safe operation of such vehicle….”

While texting while driving gets most of the media attention, many other activities can distract a driver and cause crashes, including putting on makeup, reaching for an object, or eating and drinking.

A distracted driving accident lawyer in Atlanta can help you assess the damages, collect evidence, and determine the best course of action in your case.

Georgia has a “Hit and Run” law: O.C.G.A. § 40-6-270. Under this law, a driver must do certain things after an accident:

(1) Stop.

(2) Render help to anyone who is injured.

(3) If necessary, contact emergency medical services and local law enforcement.

(4) Provide information (name, address, vehicle registration number, and driver’s license).

If a driver breaks the “Hit and Run” law, they can face fines, loss of license, and up to 5 years in prison.

If you’ve been injured in an accident and the other driver fled the scene, contact Mike Rafi, an Atlanta hit and run attorney, today at 404-948-3311.

Pedestrians generally have rights to be in certain locations at certain times. For example, pedestrians have the right-of-way in crosswalks. Pedestrians also have the right-of-way on public and private sidewalks. But, when an accident involving a pedestrian occurs, the outcome can be catastrophic.

On the other hand, pedestrians have certain duties. Pedestrians must follow traffic lights, do-not-walk signs, or wait-signs, and other pedestrian safety warnings and devices. If there is a sidewalk next to a roadway, pedestrians must walk on it.

When there is not a sidewalk on a public road, pedestrians should walk along towards traffic on the shoulder. Even when pedestrians have the right-of-way, they must keep a proper lookout for vehicles and other pedestrian traffic.

When a driver fails to properly yield to oncoming traffic, a rear-end collision may occur.

Head-on collisions often happen when a driver goes the wrong way down the road, causing serious injuries.

Rear-end collisions are the most common type of accidents and range from minor fender benders to severe wrecks.

Left turn accidents occur when a driver takes a legal or illegal turn, and a driver coming the other way hits them, usually T-boning them.

Though parking lot accidents are usually low-speed, they can cause whiplash, muscle and tendon strains, and more.

Because most school buses are large and do not have seat belts, these types of wrecks can result in serious injuries for bus drivers, car drivers, and passengers.

When you are a passenger in an Uber or Lyft or are hit by one, you are entitled to sue the driver who hit you and their company’s insurance should be available.

Most Common Causes of Car Wrecks in Atlanta

Car accidents can be caused by any number of factors, whether those factors are natural or caused by a driver’s actions. No matter the cause, an experienced car accident lawyer in Atlanta can help you get the full compensation you deserve for your injuries. Some of the most common causes of car wrecks include:

Dangerous road conditions

Anyone who has driven in Atlanta knows the roads are full of potholes, metal plates and poor drainage. And who can forget Snowpocalypse? These road conditions can quickly become dangerous for drivers. They can cause drivers to lose grip with the road or malfunction altogether, which can send drivers into oncoming traffic or otherwise cause wrecks.

Texting and driving

Distracted driving, including texting and driving, is one of the most serious issues on Atlanta’s roads. Though Georgia did pass a hands-free law in 2018, people still text while they’re behind the wheel. At highway speeds, reading or responding to a text can take a driver’s eyes off the road for five seconds — enough to travel 300 yards or more without looking at the road.

Drunk driving

Though distracted driving is quickly rising to become the top cause of car accidents, drunk driving is still at the top. When a person is even buzzed, they begin to lose their ability to focus on the road and make critical decisions quickly. When buzzed becomes drunk, vision may double, and driving becomes quite difficult. Georgia is one of the toughest states when it comes to drunk driving, but that doesn’t stop a lot of people from doing it.

Speeding

The temptation to drive faster than is safe is one we all face, especially when we’re in a hurry. But there’s a reason speed limits are in effect. When a driver is going too fast, it becomes more difficult to control the car properly. At high speeds, even a subtle turn of the wheel can be disastrous. In addition, it becomes much harder to stop quickly if traffic in front suddenly slows.

Recalls/Car Defects

Though manufacturers go through a painstaking process to ensure their vehicles are safe to drive, some defects may not become evident for years. For instance, engines may overheat and catch on fire after three years of use. Or, airbags may not deploy properly after a while. When manufacturing issues suddenly arise, they can cause serious, and even life-threatening, car accidents.

Driving for too long

Uber and Lyft drivers especially may be driving too long and become tired and unable to safely drive. Unlike truck drivers, there are no rules for how long an Uber of Lyft driver can drive for, so many of those drivers work a full-time job and then drive for a few more hours, which is dangerous and often results in crashes.

How Common Are Car Accidents in Atlanta?

In 2018, there were 402,380 crashes in Georgia. These resulted in 1,525 fatalities and 24,163 visible injuries. Since 2009, the number of crashes has steadily increased, as have the rate of serious injuries. The most common fatal injuries were caused by single-vehicle accidents, followed by roadway departures.

In Fulton County, where the majority of the city of Atlanta is, there were 45,944 total accidents in 2018. These resulted in nearly 700 serious injuries and 131 deaths. Alcohol use was the main cause of car accident fatalities that year, followed by speeding.

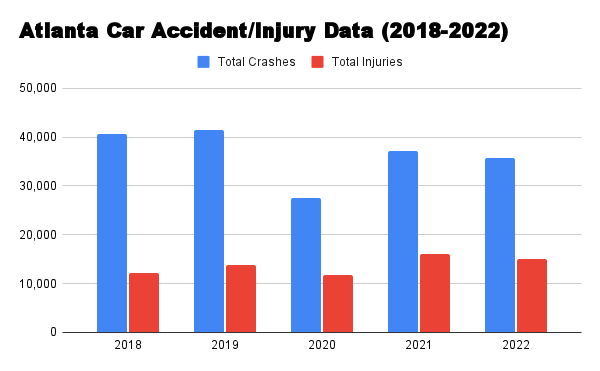

Atlanta Car Accident Statistics

Most Dangerous Intersections in Atlanta

Studies have shown that Atlanta has some of the deadliest roads in the country. The Atlanta car accident lawyers at Rafi Law Firm travel these roads every single day. When traveling through Atlanta, it is best to avoid the most dangerous intersections below to reduce your risk of a car accident:

*Average of 22 accidents per month

This road has all the makings for a dangerous intersection. Less than a mile from I-285, and several blocks over form Stone Mountain High School, this intersection has been consistently flagged as a car accident disaster waiting to happen. Both factors create a propensity to drive fast and exit the road quickly – making car wrecks that much more probable.

*Average of 13 accidents per month

An unusual amount of volume can help explain this intersection’s high-risk factors. Emory University residential and student traffic flood these streets, creating a constant stop-and-go mentality. Just about every hour of the day, this spot is backed up with traffic as people work their way to or from metro Atlanta. Be sure to stay alert as you maneuver through this intersection.

*Average of 13 accidents per month

How could anyone expect not to have accidents at an intersection this big? One of the most heavily-trafficked in Atlanta, this intersection is the perfect storm of bad drivers, road ragers, and lanes without definitive boundaries. Stay focused on the road, as well as the traffic, to avoid a potential auto accident.

*Average of 14 accidents per month

One of the main thorough fairs for Atlanta suburbs, this intersection boasts a lot of commercial developments that people must have – grocery stores, shopping centers, movie theaters, and a Whole Foods! The dangers for this road lie in the fact that, compared to city streets, these allow for more open-road driving with less stops. That gives people more time to zone out or get distracted, even with an intersection coming up. The lack of traffic signals, driver attitudes and high speeds create a recipe for an accident to occur.

*Average of 12 accidents per month

One of the more inauspicious intersections on this list, Monroe and Piedmont are tied together by their constant in-town traffic and proximity to the Belt Line. Add in bicyclists, pedestrians and constant road congestion. You can easily see how anything less than full attention can turn disastrous.

*Average of 17 accidents per month

Jimmy Carter Boulevard’s intersection with Peachtree Industrial is a treacherous spot. The Jimmy Carter/Peachtree Industrial Intersection can be very confusing. In conjunction with unmarked exits and several traffic lights, high speed traffic on Jimmy Carter merges with fast traveling traffic exiting Peachtree Industrial. Always slow down when crossing under the Peachtree Industrial Bridge to ensure that no driver inadvertently enters your path.

Contact Atlanta Car Accident Lawyer Mike Rafi to Get the Help You Deserve For Your Car Accident Case!

If you or someone you love was the victim of a car accident in Atlanta, Rafi Law Firm is here to help you. Our experienced Atlanta car accident lawyers understand how devastating a car accident can be, and we want to help alleviate your financial and emotional burden. Call us today at (404) 800-1156 or by completing our contact form to schedule a free case evaluation with Mike Rafi and our team of dedicated attorneys.

- *indicates a required field

- Lawrenceville

- Marietta

- Macon

- Norcross

- Powder Springs

- Roswell

- Sandy Springs

- Savannah

- Smyrna

- Villa Rica

- Tyler

Mike Rafi is an excellent attorney. I was injured in an automobile accident and Mr. Rafi and his partners went above and beyond.

- Sherman

- James

He was beyond professional and hardworking.

- Dashaun Frazier

We highly recommend Rafi Law Firm! Mike’s services led to the most equitable outcome.

- Beverly Busse