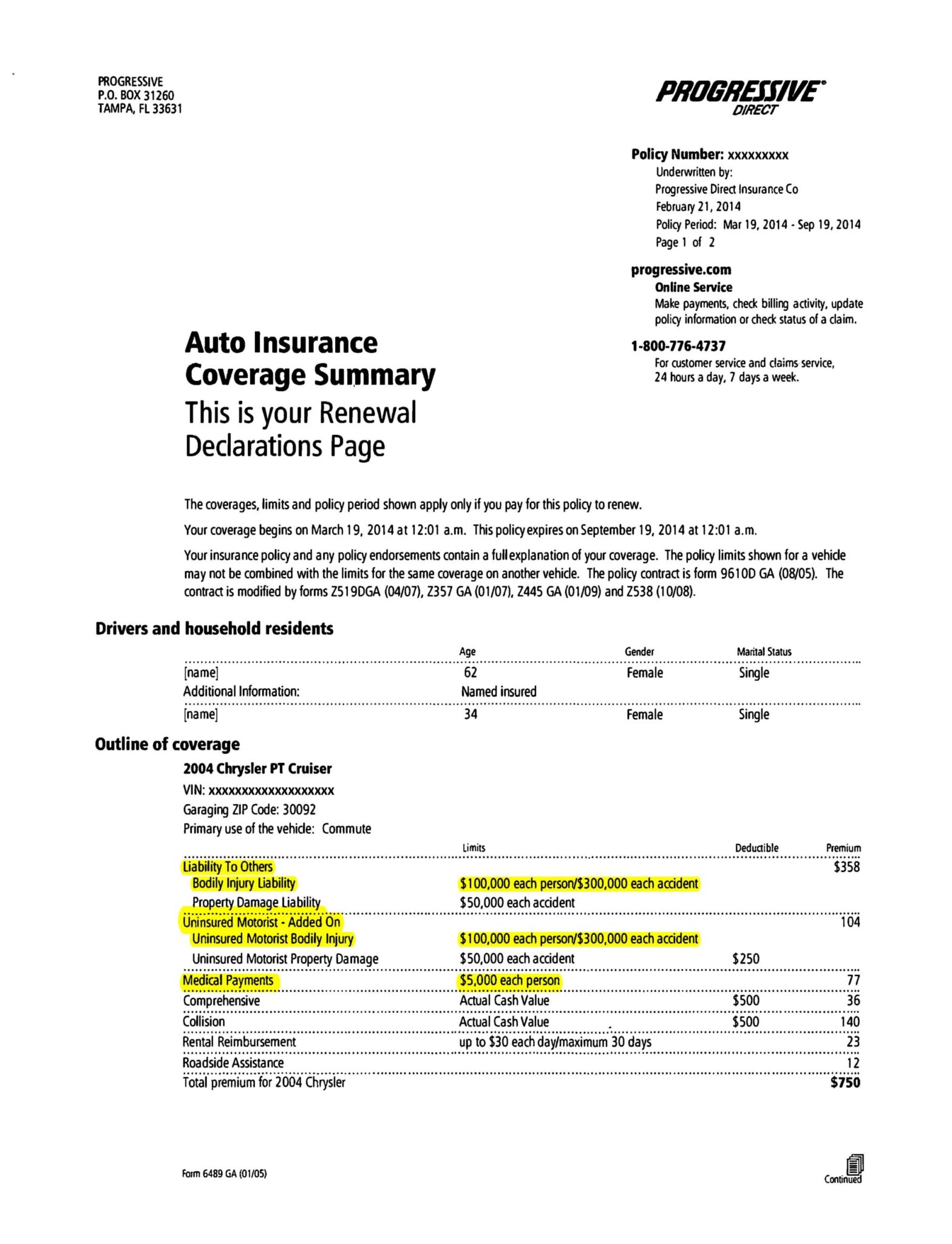

If I had a dollar for every time someone told me they had “full coverage” … I would have a lot of dollars. “Full coverage” does not exist—there is literally no such thing. Generally, I think when people say they have full coverage, they mean they have the 5 primary kinds of auto insurance coverage:

- Liability

- Uninsured/under-insured motorist

- Medical payments (med-pay) coverage

- Collision

- Comprehensive

The first 3 types—liability, uninsured/under-insured motorist, and med-pay—will be important during a personal injury claim. The last 2 types—collision and comprehensive—relate to property damage: collision coverage insures your car if it is in an accident, and comprehensive coverage insures your car if it is damaged in something other than an accident, maybe because of hail, a tree falling, or vandalism.

Liability Coverage

Liability insurance protects other people and other peoples’ property in case you are at fault in a wreck. In Georgia, drivers must have $25,000 in coverage to protect 1 person in a crash and $50,000 total in coverage to protect multiple people in a crash. So, if you are at-fault in a collision and hit a car with only 1 occupant, then you must have at least $25,000 in coverage, but if you hit a car with more than 1 occupant then you must have at least $50,000 in coverage. The harsh reality, though, is that many, many wrecks cause injuries and medical bills often exceed $25,000 or even $50,000.

Uninsured/under-insured (“UM”) motorist coverage

Even though drivers should have insurance, estimates show about 16% of Georgia drivers and almost 14% of drivers across the county are uninsured.

UM coverage protects you if you are in a wreck with someone who: 1) leaves the scene and you don’t find out who the person is, 2) does not have liability insurance at all, or 3) does not have enough liability insurance so that you are fairly compensated after the wreck. What is surprising to me is how many people have more liability insurance than UM coverage. If that is you, then you are protecting other drivers more than you are protecting yourself! That is crazy! UM coverage is also relatively cheap to increase. My recommendation is always to have at least the same amount of UM coverage as liability, if not more.

In practical terms, imagine that you are hit by another driver, and take a trip to the hospital—that’s a thousand or two for your ambulance ride. Then, you find out that you need some tests done—that’s more money. After that, you need follow-ups, more tests, physical therapy, injections for pain, and maybe even surgery. It is easy to see how medical bills can quickly rise above the $25,000 minimum insurance requirement.

For my numbers people, if you have $75,000 in medical bills, but the driver who caused the accident only has $25,000 in insurance coverage, then without UM insurance, you would be responsible for $50,000 in bills. But, if you do have UM coverage, you may not be in such bad shape. If you have $100,000 in UM coverage, then you may be entitled to $50,000 for your medical expenses, plus the other $50,000 for pain and suffering. By having UM coverage in this example, you went from owing $50,000 in medical bills to having all of your medical bills paid for and maybe receiving $50,000 on top of that.

Med-pay coverage

Med-pay coverage is like automobile health insurance—meaning, med-pay will pay for your medical bills that result from an automobile accident. Med-pay will not only cover you, but also passengers in your car.

Making sure that you know what kind of coverage you have before an accident is important—if you don’t have the right coverage, you could be in trouble if an accident does happen. After a collision, finding out how much insurance the other driver has is very important and needs to be done immediately. Your lawyer should also confirm your own auto coverage and take the necessary steps to make sure you can recover that insurance if you need it.

To learn more about insurance, including seeing a sample insurance policy that shows you where to look on your policy to see your coverage amounts, click here. If you have been involved in an automobile accident, please give us a call so that we can determine what insurance you may be entitled to.